Sales and use tax computation

Sales tax applies to retail sales of certain tangible personal property and services. Sales Use Taxes information registration support.

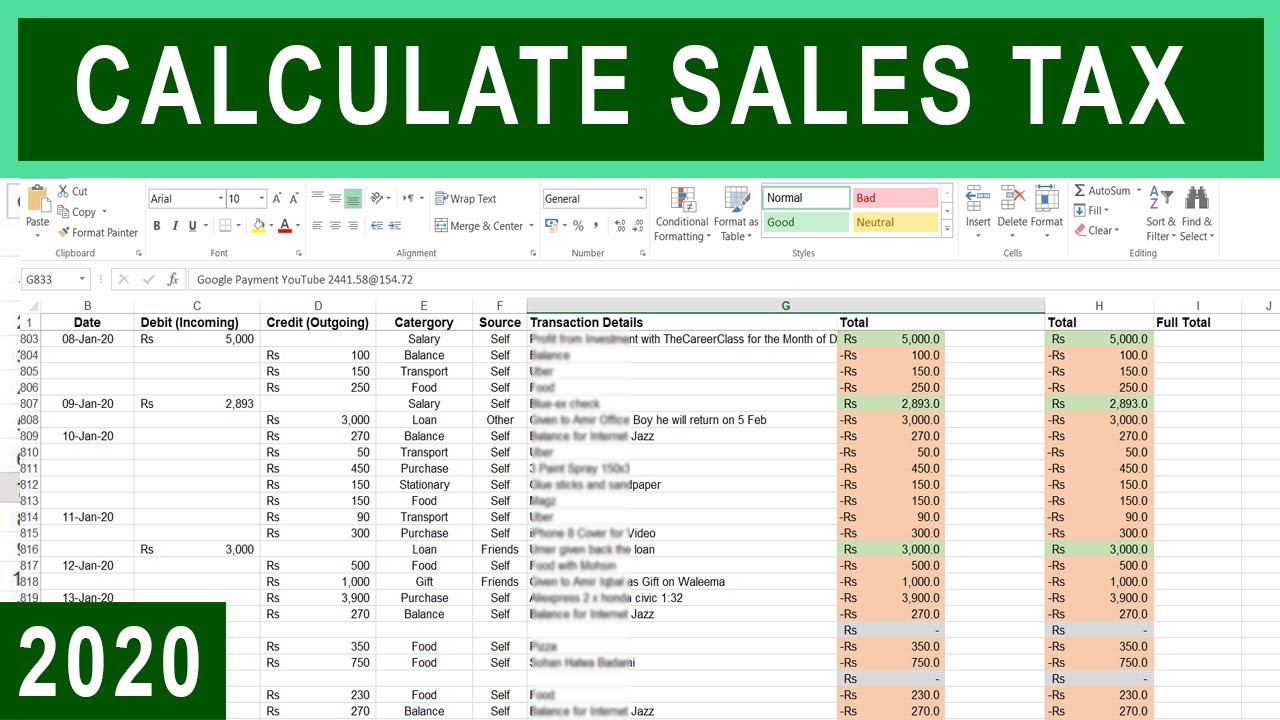

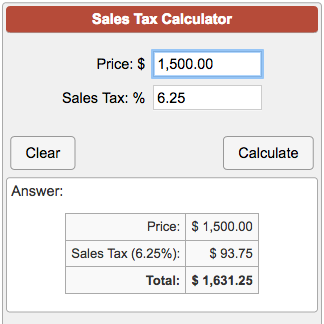

How To Calculate Sales Tax In Excel

There are three steps you can follow to use the sales tax formula.

. Use tax applies if you. Address below and get the sales tax rate for your exact location. Use tax is a tax on goods or services purchased outside of a buyers home state andor that they didnt pay sales tax on.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Easily manage tax compliance for the most complex states product types and scenarios. Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions.

Add up all sales taxes. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. Use this calculator to find the general state and local sales tax rate for any location in Minnesota.

Add up all the sales. How to Calculate and Pay Estimated Sales and Use Tax. Local taxing jurisdictions cities counties special.

Calculate the combined sales. The 6 percent tax rate is applied to a portion of the sale of new mobile homes and modular buildings as well as a portion of the gross receipts from vending machine sales. Hit enter to return to the slide.

This calculation only applies to sale transactions arising. Businesses use the following steps to calculate the amount of sales tax a customer owes. Measure reported Measure reported Measure found Compliance ratio Provided the taxpayers use tax.

Ad Accurately file and remit the sales tax you collect in all jurisdictions. The amount of sales tax to be paid is calculated by multiplying the amount paid for goods or services by the tax rate. Washington has a 65 statewide sales tax rate but.

The Nebraska state sales and use tax rate is 55 055. Floridas general state sales tax rate is 6 with the following exceptions. Sales Tax Rate Calculator.

The results do not include special local taxessuch as admissions. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

District of Columbia has a 6 statewide sales tax rate. How o Calculae and Pay Esmaed Sales and Use Tax. Ad New State Sales Tax Registration.

Usually the vendor collects the sales tax from the consumer as the consumer makes. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 percent and 39 percent. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or.

If only the state sales or use tax of 6 applies divide the gross receipts by 106 as shown in the example below. Sales tax calculator and tax rate lookup tool Enter your US. Multiply by the sale price.

Ad Produce critical tax reporting requirements faster and more accurately. State sales and use taxes provide. Get a demo today.

Gather local sales tax rate information. Determine Rates - Or - Use my current location Why cant I just use. Subscribe to Sales tax emails to receive notifications as we issue additional guidance.

Virginia Tax will continue to compute the use tax compliance ratio as follows. The 6 percent tax rate is applied to a portion of the sale of new mobile homes and modular buildings. The tax calculation would be 09347.

General Tax Adminisraon Program. Add the sales tax to the sale price. The buyer pays this tax to the tax authority usually on a state income.

54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

How To Calculate Sales Tax In Excel Tutorial Youtube

Tax Computation Report Payroll

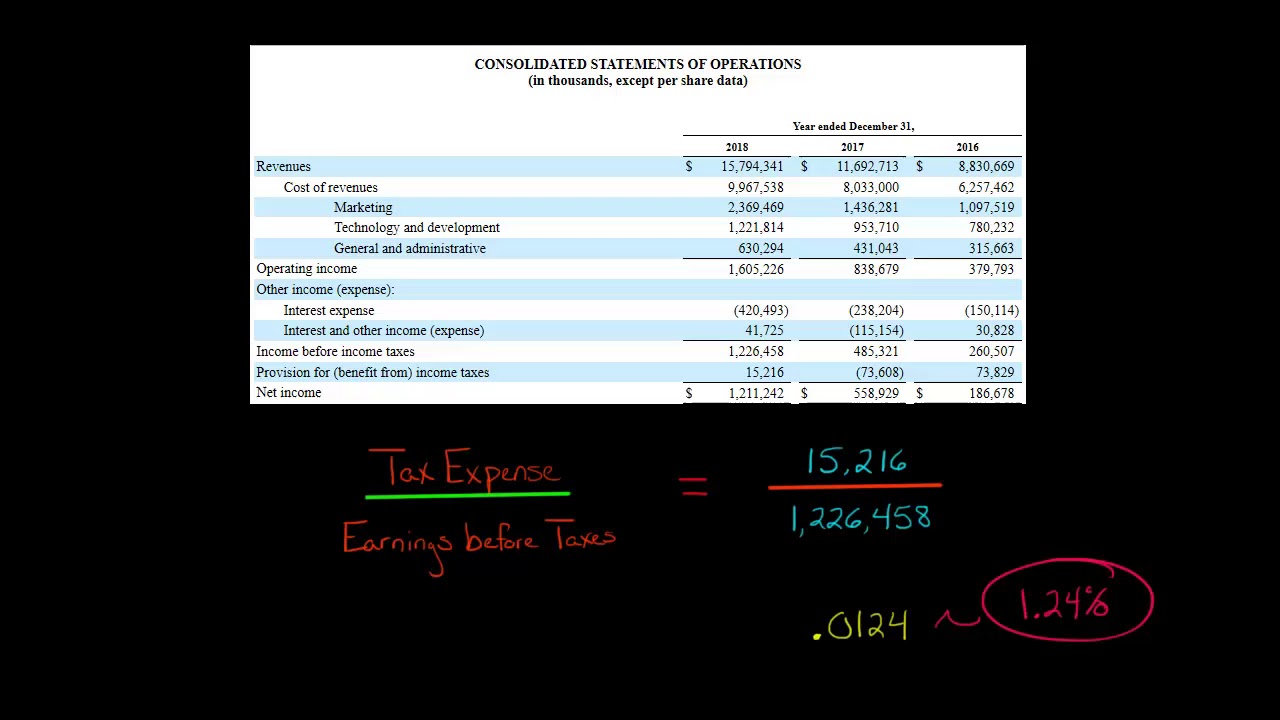

How To Calculate Income Tax In Excel

Small Business Tax Deductions Small Business Tax Business Tax Deductions

Softax Private Limited 3 Hours Workshop On E Filing Of Income Tax Return Tax Year 2018 Step By Step Understanding Income Tax Return Income Tax Tax Return

Computation Of Consumption Tax And Business Income Tax Liabilities In Download Table

An Exclusive Solution For All Your Tax Filing Needs Features That Help You Make Tax Filing 100 Accurately Spect Filing Taxes Income Tax Return Tax Software

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax In Excel

How To Calculate The Taxes Gst Pst And The Final Price Youtube

Small Business Tax Deductions Small Business Tax Business Tax Deductions

How To Calculate The Effective Tax Rate Youtube

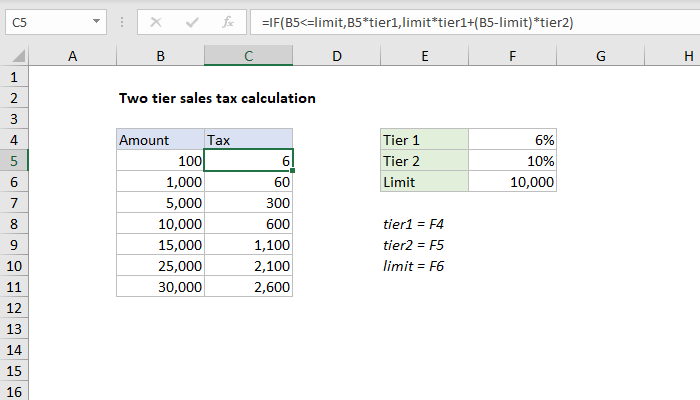

Excel Formula Two Tier Sales Tax Calculation Exceljet

Income Tax Computation Format Pdf Simple Guidance For You In Income Tax Computation Format P Tax Forms Income Tax Income

Sales Tax Calculator

What Are Earnings After Tax Bdc Ca